2 10 N 30 Journal Entry Example

Ships 1 000 of goods to a customer.

2 10 n 30 journal entry example. Top 10 examples of journal entry. Journal entries for trade credit. Net method and gross method. In her business equipment does all of the heavy lifting that human resources can not.

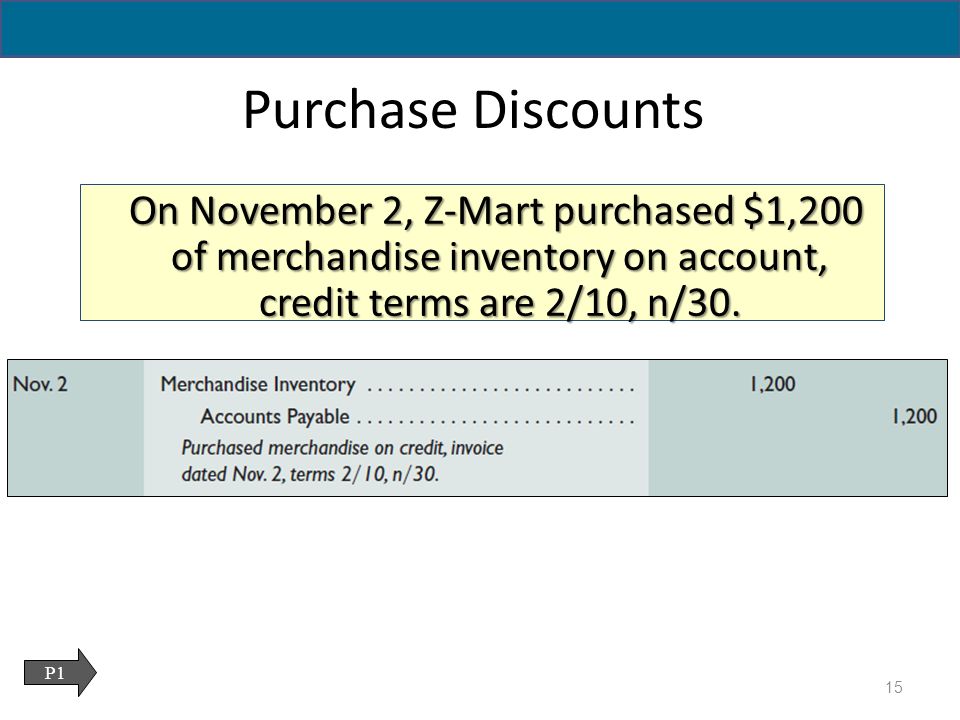

There are two methods of accounting for discounts. Mary has purchased many pieces of equipment. What is the definition of 2 10 net 30 credit terms. 2 10 net 30 is a cash discount term where customers have 30 days to pay for a purchase but can receive a two percent discount if the entire purchase paid in full within ten days.

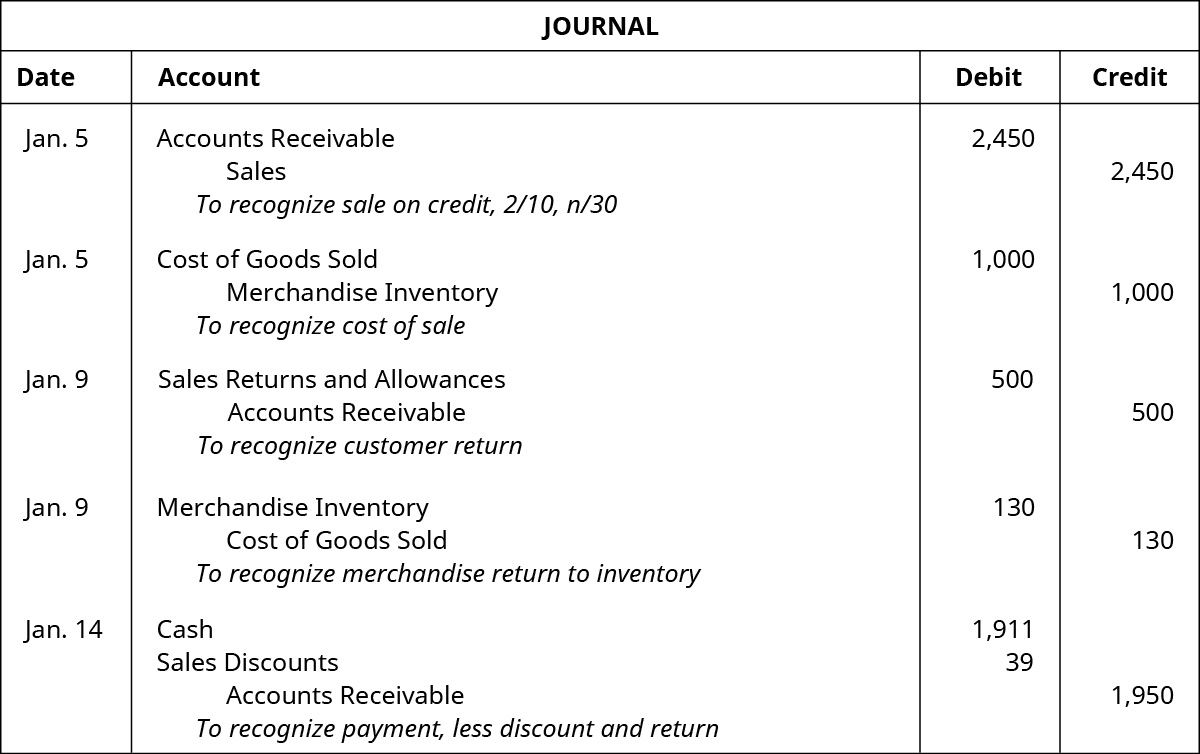

November 3 sold merchandise on account for 5000 terms 1 10 n 30. The cost of the merchandise sold was 3000. Cash discount is an expense for seller and income for buyer. Less 2 equals 4900.

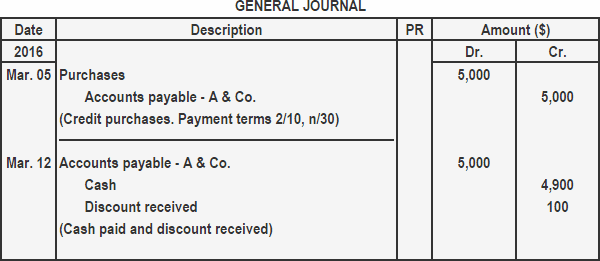

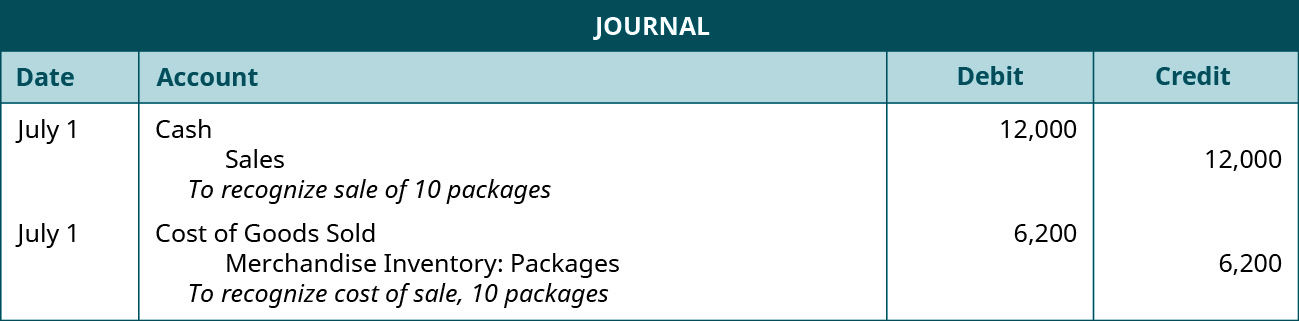

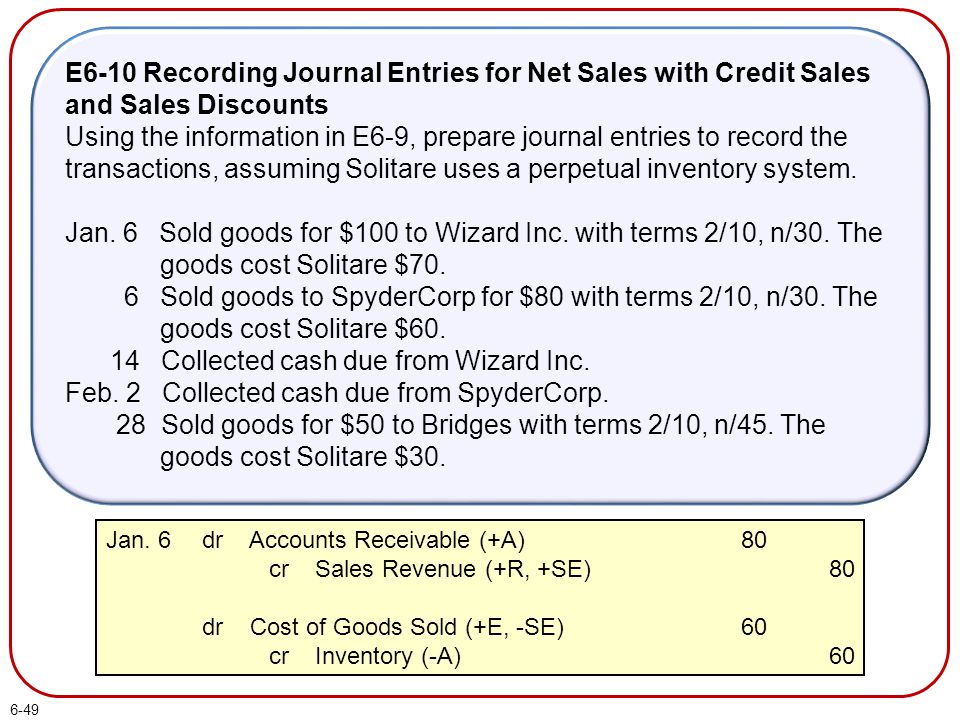

The following journal entry examples in accounting provide an understanding of the most common type of journal entries used by the business enterprises in their day to day financial transactions. Terms of the sale are 2 10 n 30. Within ten days company a remits the invoice. The net method and gross method journal entries are provided.

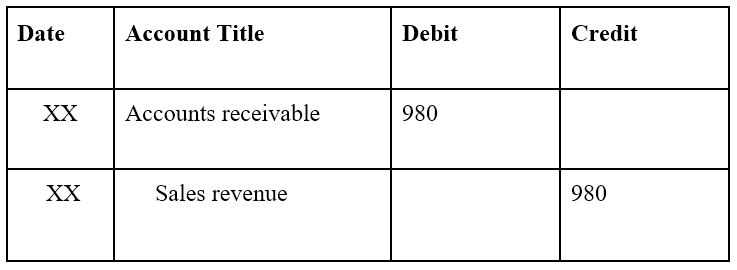

Mary has started a processing plant for natural vegan snacks. Debit cash 4900 debit sales or service discounts 100 credit accounts receivable 5000. Let s see how the credit term of 2 10 n 30 works in an example. For example the terms 2 10 n 30 means a 2 discount will be allowed if the payment is made within 10 days of the date of invoice otherwise the full amount is to be paid in 30 days.

Company a purchases 5000 in inventory from company b. As business events occur throughout the accounting period journal entries are recorded in the general journal to show how the event changed in the accounting equation. The percentage of cash discount is mentioned in payment terms. One of these is a large oven to bake her healthy snacks in.

2 10 net 30 example. Hey guys i have to put these in journal entries can you see if i did them correct november 1. A customer of company a realizing that the company is offering credit terms of 2 10 net 30 decides to make a purchase of 1 000. Purchased merchandise on account from toys r us for 6000 terms 2 10 n 30.

Example of jounal entry includes the purchase of machinery by the country where machinery account will be debited and the cash account will be credited. Within 10 days of the invoice date the customer is allowed to deduct 20 2 of 1 000 from the purchase of 1 000. This is the cash discount terms for a credit transaction. Received credit from toys r us for merchandise returned 500.

For example 2 10 days net 30 terms or 2 10 n 30 means that a 2 discount can be taken if payment is made with 10 days otherwise the full amount is due within 30 days. Let us consider the following example. Journal entry for cash discount. Michael co ltd.

2 10 represents a 2 percent discount when payment is made to the. For example when the company spends cash to purchase a new vehicle the cash account is decreased or credited and the vehicle account is increased or debited. 2 10 net 30 example. If the customer pays michael co ltd.