2 10 N 30 Accounting

A customer of company a realizing that the company is offering credit terms of 2 10 net 30 decides to make a purchase of 1 000.

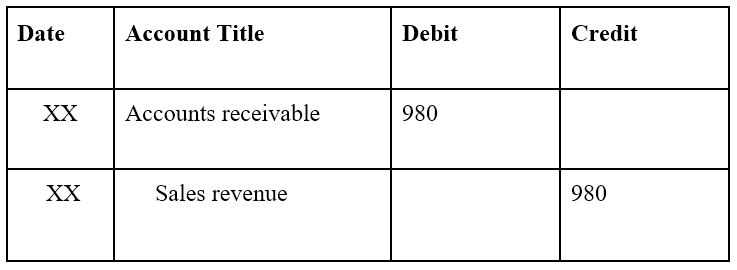

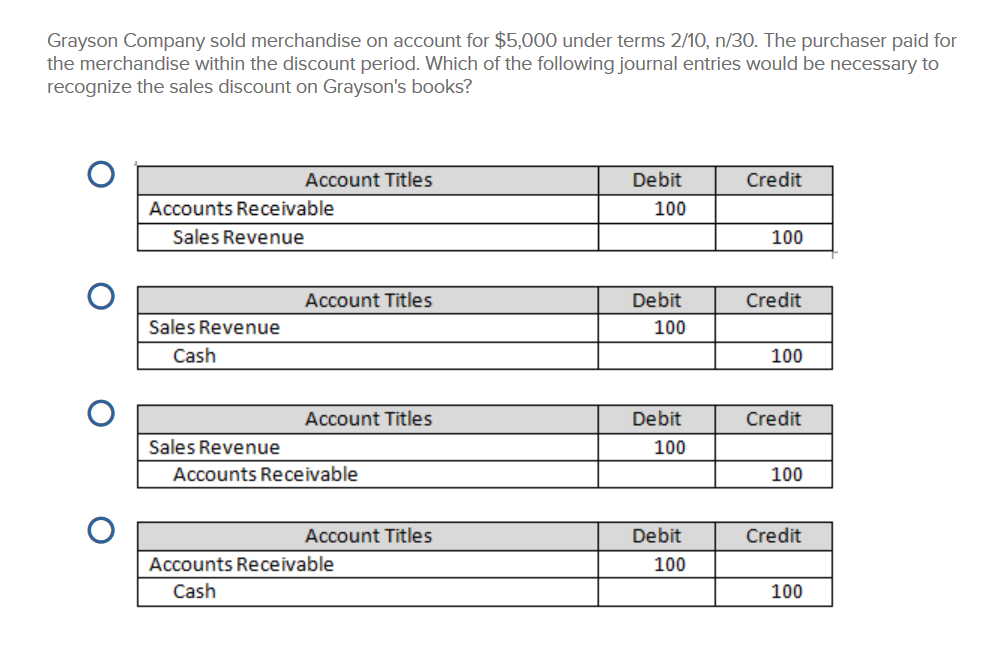

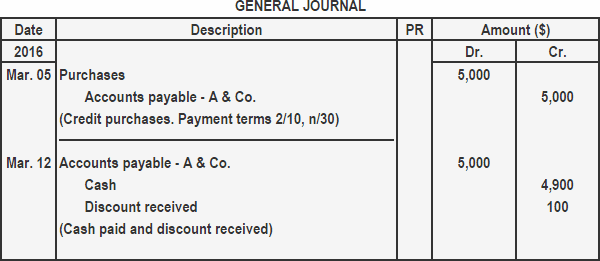

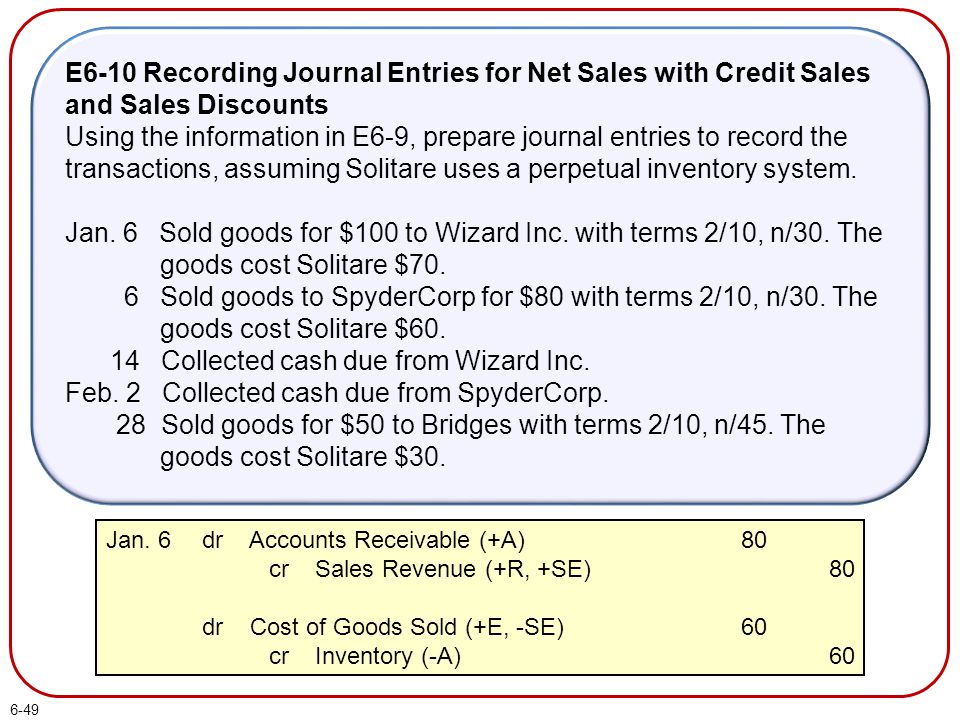

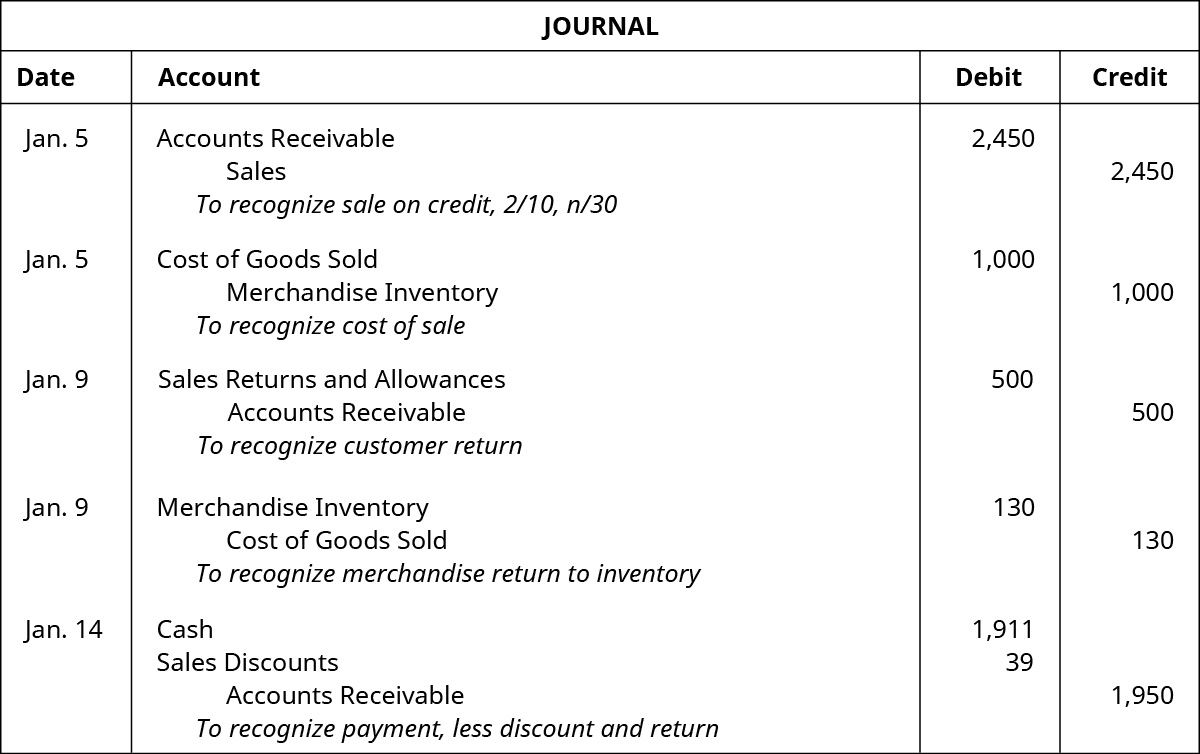

2 10 n 30 accounting. 2 10 n 30 journal entries vary depending on the accounting method used. 2 shows the discount percentage offered by the seller. 10 qualifies for the discount. Strong company policies must be in place to ensure smooth bookkeeping.

The term 2 10 n 30 is a typical credit term and means the following. 2 10 net 30 example. Lifo vs fifo accounting vs economic income and many other matters make 2 10 n 30 accounting somewhat complicated. Indication 2 10 n 30 or 2 10 net 30 on an invoice represents a cash sales discount provided by the seller to the buyer for prompt payment.

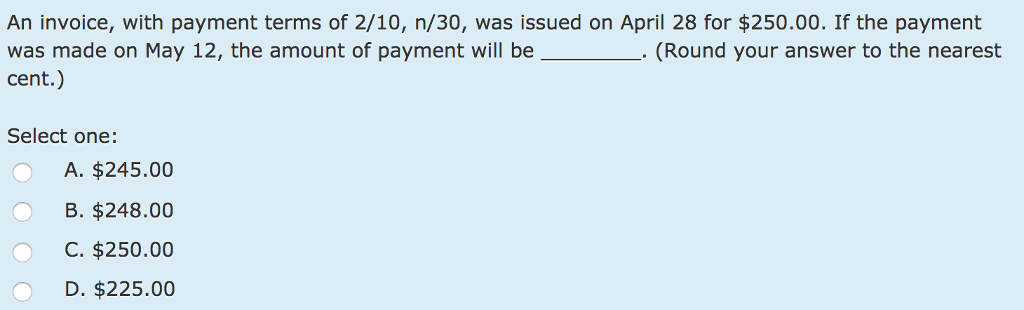

Net method and gross method. She has been offered 2 10 net 30 payment terms. For example 2 10 days net 30 terms or 2 10 n 30 means that a 2 discount can be taken if payment is made with 10 days otherwise the full amount is due within 30 days. 2 10 or 1 10 n 30 are discounts that offer an incentive for a customer to pay for purchases in a timely manner.

In this case the discount is 2 percent so multiply the total bill by 0 98 to determine the amount of payment. One of these is a large oven to bake her healthy snacks in. Mary has started a processing plant for natural vegan snacks. A company offering terms of 2 10 is offering a discount of 2 provided that the invoice is paid within 10 days.

First ensure that you are within the time period for the discount by adding the number of days to the date on the invoice. 2 10 n 30 if the vendor s invoice has terms of 2 10 n 30 the 2 represents 2 the 10 represents 10 days the n represents the word net and the 30 represents 30 days. 30 with the terms as 2 10 net 30 payment by dec. There are two methods of accounting for discounts.

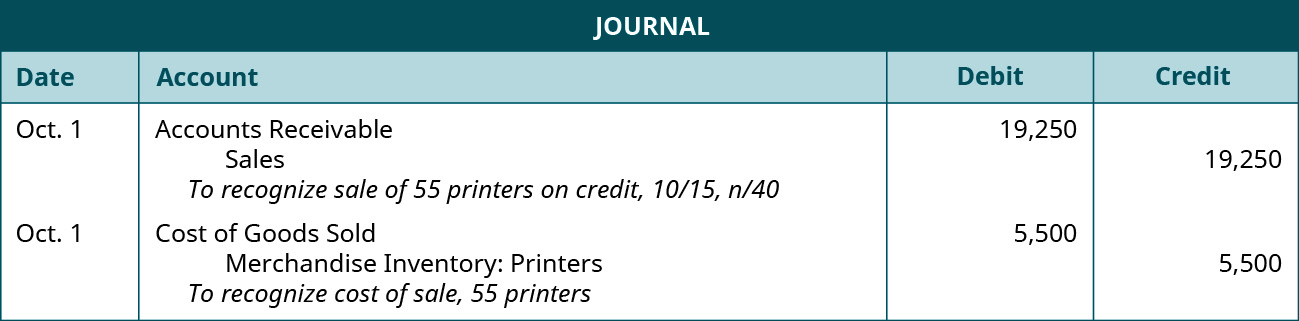

The net method and gross method journal entries are provided below. Net 30 terms are often combined with a cash discount for early settlement. 2 10 net 30 is a cash discount term where customers have 30 days to pay for a purchase but can receive a two percent discount if the entire purchase paid in full within ten days. Home accounting dictionary what is 2 10 n 30.

This means that the buyer can take an early payment discount of 2 of the amount owed if the amount is remitted within 10 days instead of the customary 30 days. Net 30 terms or n 30 means that payment in full is due 30 days after the date of the invoice. Mary has purchased many pieces of equipment. In her business equipment does all of the heavy lifting that human resources can not.